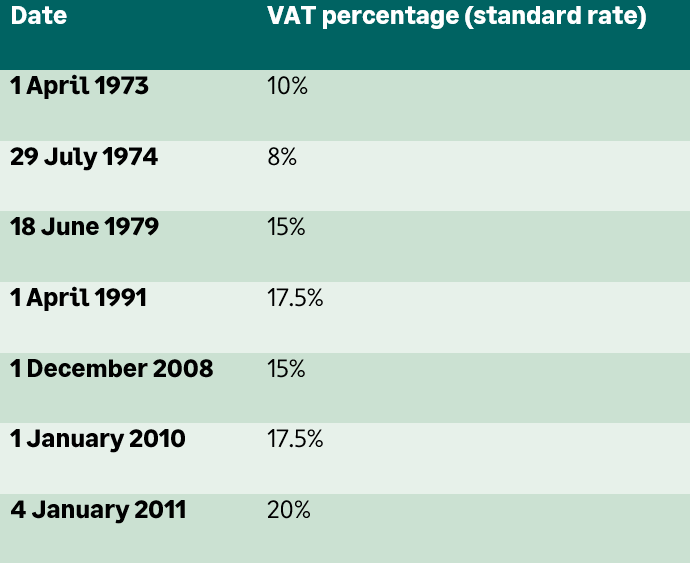

What Is Vat Uk . The standard rate of vat in the. The standard rate of vat in the. vat is levied on most goods and services provided by registered businesses in the uk and some goods and services imported. value added tax, or vat, is the tax you have to pay when you buy goods or services. Some things are exempt from vat, such as postage. Vat (value added tax) is a tax the government adds to most products and services. vat, or value added tax, is levied on the sale of goods and services in the uk. what is vat? the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). value added tax, or vat, is the tax you have to pay when you buy goods or services. It is a type of consumption tax”.

from www.sage.com

Vat (value added tax) is a tax the government adds to most products and services. value added tax, or vat, is the tax you have to pay when you buy goods or services. The standard rate of vat in the. what is vat? It is a type of consumption tax”. The standard rate of vat in the. vat is levied on most goods and services provided by registered businesses in the uk and some goods and services imported. Some things are exempt from vat, such as postage. value added tax, or vat, is the tax you have to pay when you buy goods or services. vat, or value added tax, is levied on the sale of goods and services in the uk.

UK VAT rates and VAT FAQs Sage Advice United Kingdom

What Is Vat Uk the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). vat is levied on most goods and services provided by registered businesses in the uk and some goods and services imported. The standard rate of vat in the. value added tax, or vat, is the tax you have to pay when you buy goods or services. Vat (value added tax) is a tax the government adds to most products and services. value added tax, or vat, is the tax you have to pay when you buy goods or services. what is vat? Some things are exempt from vat, such as postage. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). vat, or value added tax, is levied on the sale of goods and services in the uk. The standard rate of vat in the. It is a type of consumption tax”.

From www.sage.com

What is VAT? UK VAT basics Sage Advice United Kingdom What Is Vat Uk Some things are exempt from vat, such as postage. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). vat, or value added tax, is levied on the sale of goods and services in the uk. The standard rate of vat in the. value added tax, or vat, is the tax you have. What Is Vat Uk.

From www.annetteandco.co.uk

What is VAT? UK VAT Value Added Tax in the UK What Is Vat Uk vat, or value added tax, is levied on the sale of goods and services in the uk. what is vat? The standard rate of vat in the. The standard rate of vat in the. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). value added tax, or vat, is the tax. What Is Vat Uk.

From claiminggoyaowa.blogspot.com

Claiming Uk Claiming Vat Back What Is Vat Uk The standard rate of vat in the. what is vat? value added tax, or vat, is the tax you have to pay when you buy goods or services. Vat (value added tax) is a tax the government adds to most products and services. The standard rate of vat in the. It is a type of consumption tax”. . What Is Vat Uk.

From www.deskera.com

UK VAT (Value Added Tax) Guide Updated for Post Brexit Impact What Is Vat Uk The standard rate of vat in the. Vat (value added tax) is a tax the government adds to most products and services. vat, or value added tax, is levied on the sale of goods and services in the uk. Some things are exempt from vat, such as postage. vat is levied on most goods and services provided by. What Is Vat Uk.

From www.sage.com

UK VAT rates and VAT FAQs Sage Advice United Kingdom What Is Vat Uk vat is levied on most goods and services provided by registered businesses in the uk and some goods and services imported. Some things are exempt from vat, such as postage. The standard rate of vat in the. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). Vat (value added tax) is a tax. What Is Vat Uk.

From www.legendfinancial.co.uk

VAT Registration What Is It and Why You Need To Legend Financial What Is Vat Uk vat is levied on most goods and services provided by registered businesses in the uk and some goods and services imported. value added tax, or vat, is the tax you have to pay when you buy goods or services. Some things are exempt from vat, such as postage. The standard rate of vat in the. value added. What Is Vat Uk.

From vatsense.com

Brexit UK VAT number validation What Is Vat Uk value added tax, or vat, is the tax you have to pay when you buy goods or services. what is vat? The standard rate of vat in the. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). Some things are exempt from vat, such as postage. vat, or value added tax,. What Is Vat Uk.

From ember.co

How much is VAT? A guide to UK VAT rates What Is Vat Uk vat, or value added tax, is levied on the sale of goods and services in the uk. value added tax, or vat, is the tax you have to pay when you buy goods or services. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). value added tax, or vat, is the. What Is Vat Uk.

From www.youtube.com

How to apply for a VAT number? Step By Step VAT Registration UK What Is Vat Uk the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). Some things are exempt from vat, such as postage. what is vat? The standard rate of vat in the. The standard rate of vat in the. value added tax, or vat, is the tax you have to pay when you buy goods or. What Is Vat Uk.

From www.youtube.com

what is VAT and how it works in the UK? YouTube What Is Vat Uk It is a type of consumption tax”. Some things are exempt from vat, such as postage. vat, or value added tax, is levied on the sale of goods and services in the uk. what is vat? The standard rate of vat in the. vat is levied on most goods and services provided by registered businesses in the. What Is Vat Uk.

From chacc.co.uk

VAT on Food Future of VAT in Hospitality Industry What Is Vat Uk The standard rate of vat in the. Vat (value added tax) is a tax the government adds to most products and services. value added tax, or vat, is the tax you have to pay when you buy goods or services. It is a type of consumption tax”. what is vat? vat is levied on most goods and. What Is Vat Uk.

From businessfinancing.co.uk

What Does Net Of VAT Mean In The UK? 2024 Guide What Is Vat Uk Vat (value added tax) is a tax the government adds to most products and services. The standard rate of vat in the. vat is levied on most goods and services provided by registered businesses in the uk and some goods and services imported. vat, or value added tax, is levied on the sale of goods and services in. What Is Vat Uk.

From www.tide.co

A Complete Guide to VAT Codes the Full List Tide Business What Is Vat Uk Vat (value added tax) is a tax the government adds to most products and services. It is a type of consumption tax”. Some things are exempt from vat, such as postage. vat is levied on most goods and services provided by registered businesses in the uk and some goods and services imported. vat, or value added tax, is. What Is Vat Uk.

From pepnewz.com

VAT Registration In The UK A Crisp Guide For 2021 pepNewz What Is Vat Uk vat, or value added tax, is levied on the sale of goods and services in the uk. value added tax, or vat, is the tax you have to pay when you buy goods or services. Vat (value added tax) is a tax the government adds to most products and services. what is vat? It is a type. What Is Vat Uk.

From damnaconsultancy.com

UK VAT Registration DAmna Consultancy LLC What Is Vat Uk value added tax, or vat, is the tax you have to pay when you buy goods or services. vat is levied on most goods and services provided by registered businesses in the uk and some goods and services imported. It is a type of consumption tax”. what is vat? The standard rate of vat in the. Vat. What Is Vat Uk.

From help.bridallive.com

How to setup VAT(UK) or GST (Australia) BridalLive What Is Vat Uk It is a type of consumption tax”. Vat (value added tax) is a tax the government adds to most products and services. The standard rate of vat in the. The standard rate of vat in the. what is vat? vat, or value added tax, is levied on the sale of goods and services in the uk. Some things. What Is Vat Uk.

From ambiance-accountants.co.uk

VAT Ambiance Accountants Sheffield Accountants What Is Vat Uk Vat (value added tax) is a tax the government adds to most products and services. vat, or value added tax, is levied on the sale of goods and services in the uk. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). vat is levied on most goods and services provided by registered. What Is Vat Uk.

From cruseburke.co.uk

How Much is VAT in the UK Complete Guideline CruseBurke What Is Vat Uk The standard rate of vat in the. Some things are exempt from vat, such as postage. value added tax, or vat, is the tax you have to pay when you buy goods or services. It is a type of consumption tax”. the standard rate of vat increased to 20% on 4 january 2011 (from 17.5%). The standard rate. What Is Vat Uk.